13/02/2023

Author Name

12/06/2023

The rise of Non-Fungible Tokens (NFTs) has been one of the defining aspects of the emerging blockchain industry. NFTs are digital items that can be bought and sold, and they’ve become increasingly popular among consumers, investors, and entrepreneurs. But with this popularity comes the need to understand how they’re taxed. Recently, the Minnesota Department of Revenue issued new guidance on NFT taxes, providing an important reminder that businesses must remain vigilant regarding staying on top of their tax obligations. NFT sales taxes in Minnesota are curcual for all Web3 businesses to understand.

Are you an NFT artist or seller? If so, you may be surprised to learn that NFTs are often subject to sales taxes in Minnesota. However, the majority of NFT sellers are not collecting or remitting sales taxes, potentially leaving them exposed to unexpected tax liabilities. In this blog, we will dive into the details of NFT sales tax in Minnesota, including when sales taxes apply, how to determine your nexus, and strategies for collecting and remitting sales taxes. Stay ahead of the game and ensure compliance with the tax authorities.

Sales tax is a tax imposed on the sale of goods or services. In Minnesota, the sales tax rate is 6.875%. The applicability of sales taxes to NFT sales depends on the underlying product associated with the NFT. Minnesota has provided guidance on taxable and non-taxable products, such as digital audio works, digital audiovisual works, and digital books. It is crucial to review the Minnesota fact sheet for sales tax and digital products to determine the taxability of your NFTs.

The Minnesota Department of Revenue guidance states that taxable sales involving NFTs are subject to sales tax in the same way as any other purchase transaction – including those involving digital products, admissions to events, and tangible personal property. This applies even if a sale is conducted entirely with NFTs and no cash is exchanged.

Businesses should also be aware that bundles transactions may also be taxable; for example, if a consumer purchases both a non-taxable item (such as tickets for an event) and a taxable item (such as merchandise related to the event) with one payment made in NFTs, then both parts of the purchase are considered taxable under Minnesota law.

The state has also provided additional guidance regarding sourcing rules to help businesses determine which jurisdictions’ taxes apply when using NFT payments.

Sourcing rules are essential for determining whether sales taxes apply to your NFT sales. In Minnesota, the sale is considered to have taken place based on the customer’s address or location. If you have a physical presence in Minnesota or meet the economic nexus threshold (generating over $100,000 in gross revenue or conducting over 200 transactions in the last 12 months), you are likely to have a nexus in Minnesota, obligating you to collect and remit sales taxes.

To properly collect sales taxes for your NFT sales, you need to collect additional information from your customers at the time of checkout. While collecting the customer’s ZIP code may be sufficient in some cases, it may not provide an accurate combined tax rate if there are local sales taxes. Collecting the full address is ideal for precise tax calculations. However, the challenge lies in balancing customer anonymity with the need for accurate tax collection. Finding the right approach for collecting customer data is crucial for compliance. Automated Web3 NFT sales tax software like Digital Impost can streamline this process.

Failure to collect and remit sales taxes in Minnesota can lead to potential risks and consequences. Minnesota has the authority to retroactively enforce sales tax collection on prior NFT sales, resulting in unexpected tax liabilities. Non-compliance can also harm your company’s reputation and the broader NFT industry. Additionally, customers may be responsible for use tax if sales tax was not collected at the point of sale, potentially creating compliance issues for them.

Given the complexity involved in understanding how taxes apply to purchases made with NFTs, it’s essential for businesses dealing with them to ensure they stay up-to-date on all aspects of their tax obligations. Companies like Digital Impost offer services aimed at helping businesses comply with their local taxation requirements while also benefiting from utilizing blockchain technology more effectively.

Moreover, businesses should keep an eye out for changes or updates from their local government – such as new interpretations or clarifications – relating to tax rates or requirements for transactions conducted using digital assets like NFTs. Finally, companies dealing in these types of goods should pay close attention to any applicable exemptions or discounts for which they may qualify due to specific circumstances or reasons related to their business operations.

NFT businesses have a complex array of tax obligations to stay on top of, but there are some essential steps that all companies must take. To begin, NFT businesses need to be aware of the various state laws and regulations regarding the taxation of digital assets. In particular, in recent months, states like Washington, Pennsylvania, and Puerto Rico have guided how NFTs should be taxed.

These blueprints offer interpretations of existing law rather than changes in the law and can thus be applied retroactively and prospectively. Additionally, approximately 30 states already impose a sales tax on digital products or electronically delivered software, which may allow them to claim retroactive taxing authority over NFT transactions.

The tax obligations for NFT sellers are complex. From determining nexus to collecting and remitting the revenue, business owners have a lot to stay on top of. Fortunately, there are steps that NFT businesses can take to ensure compliance with state sales taxes.

First, NFT businesses must keep detailed records of their transactions and buyer information, including location data. This will help them determine which states they have nexus in and what their tax obligations are in each state. It also serves as evidence in case of a sales tax audit.

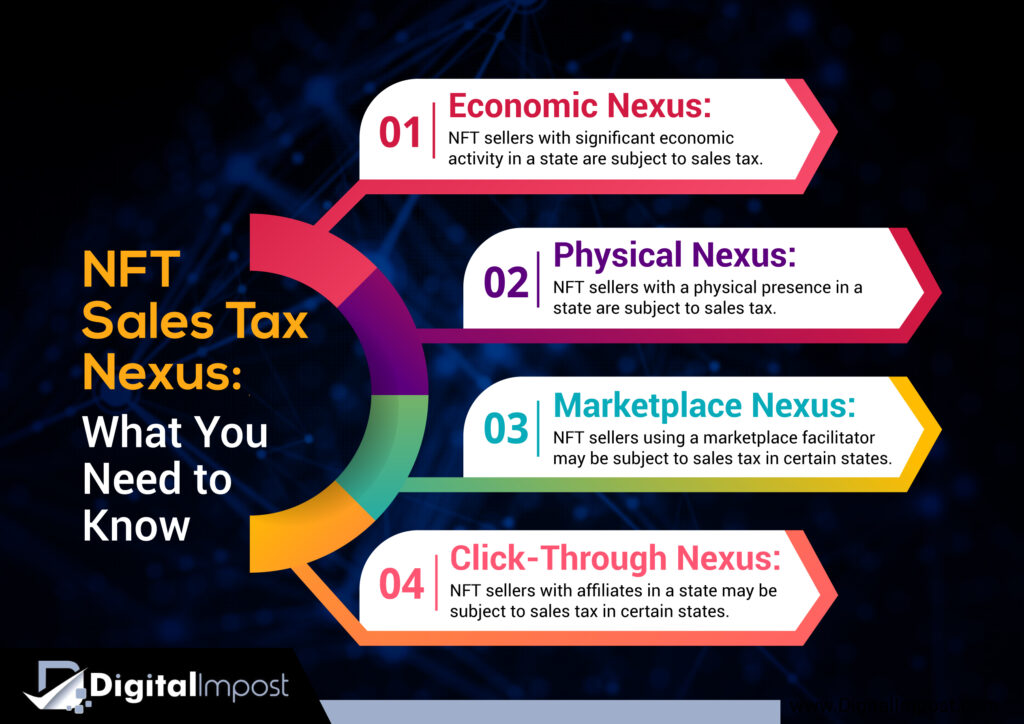

Nexus is an important concept regarding sales taxes — it determines if a seller has sufficient connection with a state and thus must pay sales taxes in the state. Depending on where the buyer is located, NFT businesses may need to register to collect sales taxes in certain states. They will also be responsible for calculating the applicable rate, collecting buyer payments, and remitting the revenue to the relevant state authorities.

In conclusion, NFT businesses need to understand their obligations when it comes to taxation to remain compliant with state laws and avoid costly penalties due to non-compliance. Keeping track of transaction records and buyer information is essential; additionally, taking advantage of services or software that simplify tax management can enable entrepreneurs to focus more on growing their business than worrying about tax compliance.

Navigating NFT sales tax in Minnesota requires careful consideration of the underlying product, sourcing rules, nexus determination, and proper collection of customer information. To stay compliant, it is essential to understand the tax obligations associated with your NFT sales and take appropriate measures to collect and remit sales taxes. Stay informed, protect your business, and contribute to the growth of the NFT industry while meeting your tax obligations.

As the popularity of NFTs and cryptocurrency continues to rise, so do the complexities of tax compliance. Enter Digital Impost, a cutting-edge Web3 sales tax software designed to help NFT creators, sellers, and marketplace facilitators navigate the intricate world of sales tax with ease and accuracy.

Digital Impost is the leading software for digital asset sales tax compliance, serving businesses transacting in cryptocurrencies, NFTs and other digital assets. Our NFT sales tax software uses advanced algorithms and data analysis to accurately calculate, collect and report on digital asset sales tax liabilities for digital asset transactions. Digital Impost is pioneering the next generation of sales tax tools for the next generation of businesses, visit digitalimpost.com.

For NFT artists, collectors, and marketplace facilitators, Digital Impost is a game-changer. By automating Web3 NFT sales tax compliance, it allows them to focus on what they do best: creating and trading NFTs. With Digital Impost, businesses can avoid the headaches of manual tax calculations, data management, and reporting, enabling them to stay compliant without sacrificing valuable time and resources.

Digital Impost also provides education and support, helping users navigate the complex world of Web3 sales tax. From understanding the tax implications of different transactions to staying informed about changes in regulations, Digital Impost equips businesses with the knowledge they need to make informed decisions and minimize the risk of non-compliance.

Check out our NFT Sales Tax Resources

Contact Our Team To Learn About Our Web3 NFT Sales Tax Software

Read More Blogs on Web3 Sales Taxes for NFTs and Digital Assets