13/02/2023

Patrick Camuso, CPA

13/02/2023

Are you an NFT collector or artist based in Washington? It’s essential to understand that NFTs are subject to sales taxes in Washington state. It’s crucual to understand NFT sales taxes in Washington to protect your Web3 business. In this informative blog post, we will explore when sales taxes apply to NFT sales, how to collect and remit these taxes, and how to ensure compliance to avoid unexpected tax bills and reputational risks.

Sales tax is a tax levied at the time of sale, usually collected by the seller and remitted to the state tax jurisdiction. In Washington, the sales tax rate is 6.5%. But when do sales taxes apply to Web NFT sales?

Washington is one of the few states that has released an official statement regarding the taxability of non-fungible tokens (NFTs). Washington is leading the charge in the Web3 when it comes to NFT sales tax guidance. As such, NFT sellers need to understand the types of NFT arrangements and mixed transactions when determining the sales tax implications. According to Washington State’s interim guidance, there are different scenarios to consider.

If you’re selling a standalone NFT, where the customer’s main purpose is to obtain the NFT itself, sales taxes will apply. However, if the NFT purchase is for obtaining an underlying product or service, you need to determine the taxability based on the underlying goods or services and how Washington State applies sales taxes to them.

Mixed transactions involving goods and services can often create further complications when determining which portion of the transaction is subject to sales taxes. In these cases, it is necessary to determine which part of each transaction qualifies as a taxable event before calculating any applicable taxes. For bundled transactions involving multiple goods or services, buyers should take special care in unbundling them into separate components so that applicable taxes are properly calculated based on each item’s classification.

In addition to the sales tax rate, certain transactions may also be subject to a Business and Occupations tax, depending on the underlying products sold. NFT creators receiving royalties are among those who may have to pay this additional tax. Royalty payments received on an NFT are exposed to Washington B&O (Business and Occupations) taxes. Ensure you’re collecting and remitting these taxes accurately during royalty transactions.

Sourcing is a critical aspect of NFT sales tax compliance. Understanding sourcing is crucual for Web3 NFT sales tax compliance. Washington State has provided a hierarchy for sourcing NFT sales, taking into account physical locations and online sales. Collecting the purchaser’s address at the time of sale is crucial for proper tax calculation. If customer information is unavailable, the seller’s address is used, which means all taxable transactions should be sourced to Washington State.

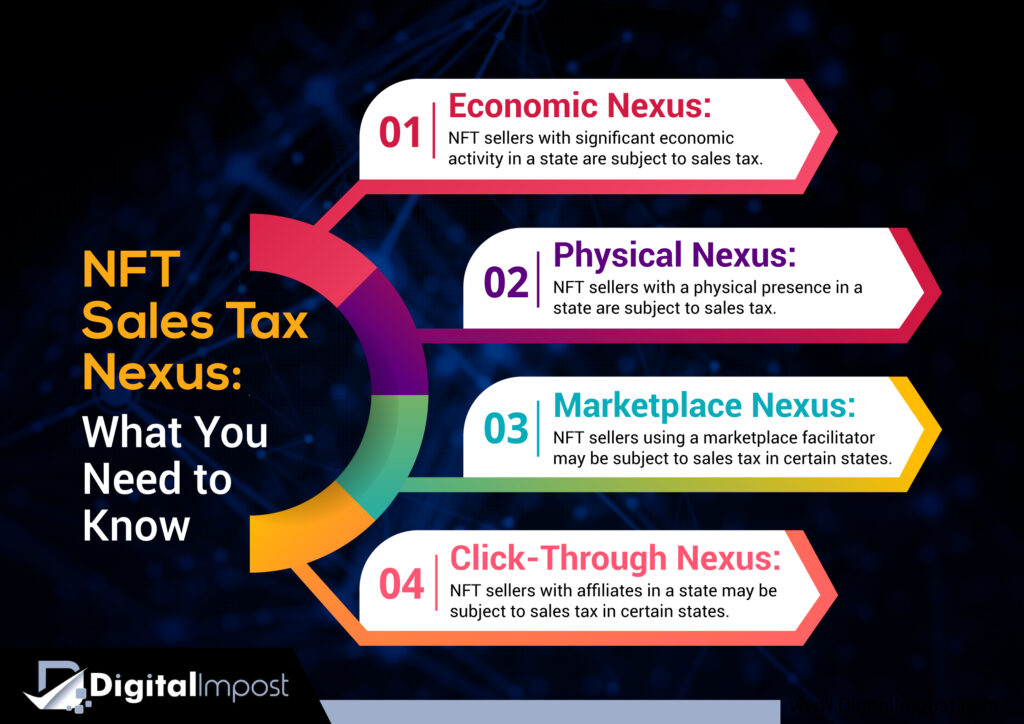

Determining your Nexus in Washington is crucial. A physical Nexus is straightforward if you have a physical presence in the state. Economic Nexus also plays a role, and you may need to collect sales taxes based on your economic activities in Washington.

To simplify the process and ensure compliance, consider using Web3 Sales Tax Software, such as Digital Impost, to collect customer information, calculate the correct tax rates, and streamline your sales tax reporting. These software solutions help you stay organized and accurately file sales tax forms with the appropriate tax jurisdictions.

Marketplace facilitators host marketplace platforms where NFT sellers can list their tokens for sale. These platforms serve as the middleman between the buyer and seller, handling all financial transactions and collecting, remitting, and reporting any taxes associated with the sale of NFTs in Washington state. A

Marketplace facilitators allowing NFT sales on their platforms may qualify as Marketplace facilitators in Washington. If they meet Nexus standards, physical or economic, they must register in Washington and collect and remit sales taxes for all sales on their platforms, including those completed by third-party sellers.

As a result, marketplace facilitators must be aware of the tax obligations of NFT sellers, including any potential retroactive sales taxes that may need to be collected and remitted. Furthermore, suppose a seller does not provide the documentation to prove that the appropriate taxes were paid on their NFTs. In that case, it is up to the marketplace facilitator to ensure compliance or risk being held liable for unpaid taxes.

To clarify tax obligations for NFTs in Washington State, the Department of Revenue has announced plans to convert its interim guidance into permanent guidance. This process will involve a continued review of this issue and engagement with external stakeholders such as industry experts and public members who may have insights into how NFT taxation should be handled in Washington State. The ultimate goal is to develop comprehensive guidelines regarding taxability and collection of sales tax on digital asset purchases so that buyers and sellers can properly prepare for their obligations under existing law.

For businesses selling non-fungible tokens (NFTs), the risk of facing retroactive sales taxes is a very real fret. However, with proper precautions and best practices in place, this risk can be mitigated significantly. To begin, businesses must ensure that all transactions are tracked and reported conscientiously. It is vital to follow each sale as closely as possible to minimize any potential losses when filing taxes due to misreporting or errors.

Businesses should consider utilizing specialized software programs such as Digital Impost to do this effectively. This software offers comprehensive tracking and reporting capabilities explicitly tailored toward the unique needs of NFT sellers. This allows businesses to easily keep accurate sales records, apply appropriate tax rates depending on the jurisdiction, and generate detailed reports when needed.

Understanding and complying with NFT sales tax regulations is crucial for maintaining a positive reputation and avoiding potential legal issues. Stay informed, protect your interests, and ensure compliance with NFT sales tax obligations.

Navigating the complex world of NFT Sales Tax in Washington presents a unique challenge for both buyers and sellers involved in digital asset transactions within this state. Therefore, all parties must understand their respective tax obligations before they are hit with hefty fines or other penalties for non-compliance issues down the line. Proper planning and preparation are essential steps towards ensuring compliance with local laws and regulations surrounding these types of transactions, which could ultimately save both buyers and sellers money in terms of avoiding penalties or fees related to unpaid taxes.

As the popularity of NFTs and cryptocurrency continues to rise, so do the complexities of tax compliance. Enter Digital Impost, a cutting-edge Web3 sales tax software designed to help NFT creators, sellers, and marketplace facilitators navigate the intricate world of sales tax with ease and accuracy.

Digital Impost is the leading software for digital asset sales tax compliance, serving businesses transacting in cryptocurrencies, NFTs and other digital assets. Our NFT sales tax software uses advanced algorithms and data analysis to accurately calculate, collect and report on digital asset sales tax liabilities for digital asset transactions. Digital Impost is pioneering the next generation of sales tax tools for the next generation of businesses, visit digitalimpost.com.

For NFT artists, collectors, and marketplace facilitators, Digital Impost is a game-changer. By automating Web3 NFT sales tax compliance, it allows them to focus on what they do best: creating and trading NFTs. With Digital Impost, businesses can avoid the headaches of manual tax calculations, data management, and reporting, enabling them to stay compliant without sacrificing valuable time and resources.

Digital Impost also provides education and support, helping users navigate the complex world of Web3 sales tax. From understanding the tax implications of different transactions to staying informed about changes in regulations, Digital Impost equips businesses with the knowledge they need to make informed decisions and minimize the risk of non-compliance.

Check out our NFT Sales Tax Resources

Contact Our Team To Learn About Our Web3 NFT Sales Tax Software

Read More Blogs on Web3 Sales Taxes for NFTs and Digital Assets